Can Kanye West Save Gap? What Maps & Location Data Reveals

On September 29 2021 Kanye West and Gap dropped the newest iteration of their partnership "The Perfect Hoodie". In a matter of hours online pre-orders for this hoodie sold out and delivered the most sales in a single day in gap.com history (according to the company).

The world took notice with Kanye himself commenting: "Ain't nobody care about the @gap till [YEEZY] went to the gap". Indeed the effect of Kanye West's partnership with Gap should not be understated– the original 10-year partnership saw Gap's stock price soaring as high as up to 40% the day of the announcement (June 26 2020). The collaboration thus far has been a slam dunk bringing YEEZY merchandise to a new audience to the Gap brand. Indeed the company announced that 70% of customers who bought the hoodie were new to the brand.

Collaborating with a polarizing figure like Kanye is a bold move by the Gap akin to Nike's Colin Kaepernick ads. It represents a step-change away from the brand's suburban image in favor of diversity and comes amidst a plan to shutter 350 different Gap and Banana Republic stores by the end of 2023.

But will the collaboration be enough to reinvigorate Gap's brick-and-mortar growth and activate a new customer?

In this post Spatial are announcing the PersonaLive Social Segmentation System on CARTO's Data Observatory and answering this question in three steps:

- Determine top Kanye following segments

- Use CARTO to map counts of Kanye followers near Gap locations

- Analyze the effect the announcement had on Gap stores near Kanye followers

Part 1: Analyzing Kanye Following Household Segments in CARTO

Spatial's PersonaLive dataset is a new segmentation that organizes every US household into one of 80 behavioral segments. Most psychographic segmentations define households singularly with demographics. Instead PersonaLive leverages demographics together with people's actual social media and cell phone visitation to determine their segment.

Factoring in real behavior (social visitation) beats demographic only segmentations four out of five times and reduces model error by an average of 17%. Social media from public profiles generates a real-time picture of viral topics by segment data from anonymous mobile devices measures visitation to any brand.

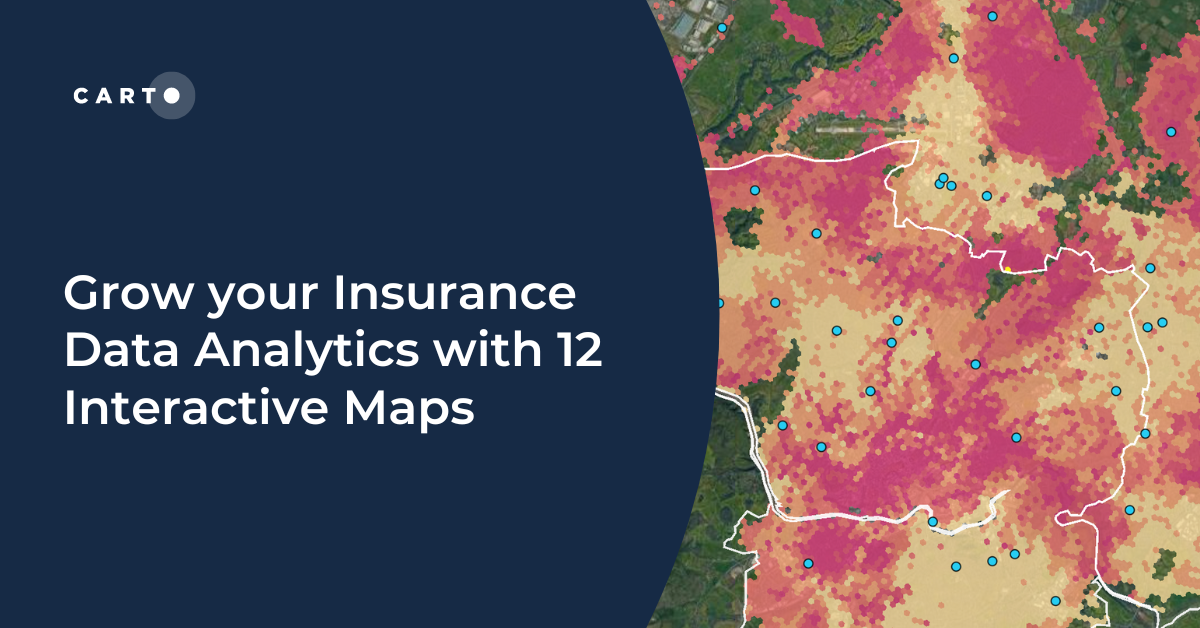

Above is an overview page for the #UrbanFashion segment on the PersonaLive platform available to CARTO users with a PersonaLive license. CARTO users can generate insights and deploy segment-specific geo-targeted social and digital campaigns from the platform.

Capturing segments following Kanye on social media helps us understand who might be most interested in the collaboration. Capturing those segments' cell phone movements lets us know if they visit Gap.

First we sort the top segments for following Kanye by using the PersonaLive platform (available to CARTO users with a PersonaLive license) to sort the top segments that follow Kanye West:

We can also look at the intersection of Kanye West followers (social media) vs. Gap visitors (mobile data) to understand households who both follow Kanye and visit the Gap.

Part 2: Analyzing Kanye Following Household Segments in CARTO

Now that we know the household segments that follow Kanye we will use CARTO to explore the percentage of Kanye households around one Gap location in Charleston South Carolina.

The map above shades block groups according to the percentage of Kanye segments. By clicking on a block group you can see the count and percentage of households highly likely to follow Kanye for that census block group.

Visualizing social media interests on the CARTO platform makes it easy to identify the influencers of the population near stores. It sets the platform for answering our overall question - what effect can the Kanye West partnership have on Gap's brick and mortar presence?

We want to see what effect the announcement may have had on Kanye following segments. We will remove the stores in which there were no Kanye following segments nearby from this analysis leaving us with 95 gap locations with Kanye following households in a 3-mile radius.

Part 3: Analyze the effect the announcement had on Gap stores near Kanye followers

The YEEZY GAP collaboration was announced on June 26 2020. That date happened three months after the advent of the pandemic which upended the economy and especially store-visitation as we knew it. The announcement occurred soon after most parts of the USA had reopened.

Our study period will be the month following the announcement and the year prior. To control for the effects of the pandemic on visitation we baseline the changes in Gap visitation to comparable changes in similar brands.

We look at three things to help us understand the effect of the announcement:

- What was Gap's standard customer set before the announcement?

- What happened to the Kanye following segments after the announcement?

- Which segments saw the most lift after the announcement?

To answer these questions we began by extracting cell phone visitation data to each Gap location using Near's impressive movement data panel. Then using the census block group of the device's common evening location we identified the likeliest PersonaLive (psychographic) segment of each individual.

By then aggregating the percentage of visits across these stores for each PersonaLive segment we can compare the psychographic profile of the Gap stores pre-announcement and post-announcement.

This is what we found:

What was Gap's standard customer set before the announcement?

Here we see the top 10 segments for visiting Gap in the year prior. After the announcement these segments overall decreased in share of Gap visitation. This is a clue that Gap's customer profile changed in the month after the announcement.

What happened to the Kanye following segments the month after the announcement?

Here we see the top 10 segments for following Kanye. After the announcement their share of Gap visitation increased overall but not by much. We note here that the median income for people in these segments is less than half of their standard.

Which segments saw the most lift after the announcement?

These segments saw the highest lift in visitation after the announcement. Notice all of them except one (B01) over-indexes for following Kanye. Unlike the previous set these have an overall higher income.

Segments who both follow Kanye AND have enough disposable income to shop at the Gap had the highest increase in visitation after the Gap <> Kanye collaboration announcement.

Conclusion

It was not simply the segments with the highest propensity to follow Kanye that had the highest lift in visitation post announcement it was those who both follow Kanye AND have enough disposable income to shop at the Gap. The latter group jumped from representing 26.40% of Gap store visitors to 29.39% - a 3% increase in one month. This trend if continued could mark a substantial brand reinvention.

If the increase in physical visitation noted gives indication of a step in the right direction then e-commerce and social metrics are a sprint towards success. We've already discussed the wild success of the YEEZY Gap products online (selling out almost immediately). However PersonaLive provides another unique lens into the Kanye Gap collaboration. Let's take another look at the segments that follow Kanye West but this time compare to their likelihood to follow Gap and competing brands.

The top 5 segments that follow Kanye West on social media are approximately Fifty Seven Percent (57%) more likely to follow Gap on social media than the average person. Compare that to Old Navy Banana Republic and J. Crew. Old Navy is the nearest sitting at 25%. This partnership as measured by social media following and e-commerce sales is having the desired effect on consumers.

Recommendations

This analysis is limited to the 95 stores in which Kanye following segments were present. Many existing Gap locations are in areas where these segments are not present. Still the trend here points to an opportunity for the Gap to resonate with a new customer base that if cultivated could potentially spell out a new brand image for the Gap that drives sales and reverses their growth trend. Gap is in a prime position to make this bold move with the clean slate of closing ⅓ of their stores.

By using the following strategies with CARTO and PersonaLive Gap can maximize the effect of the Kanye collaboration:

1. Deploy personalized ads to Kanye following segments near existing stores

2. Analyze eCommerce sales to inform omnichannel strategy

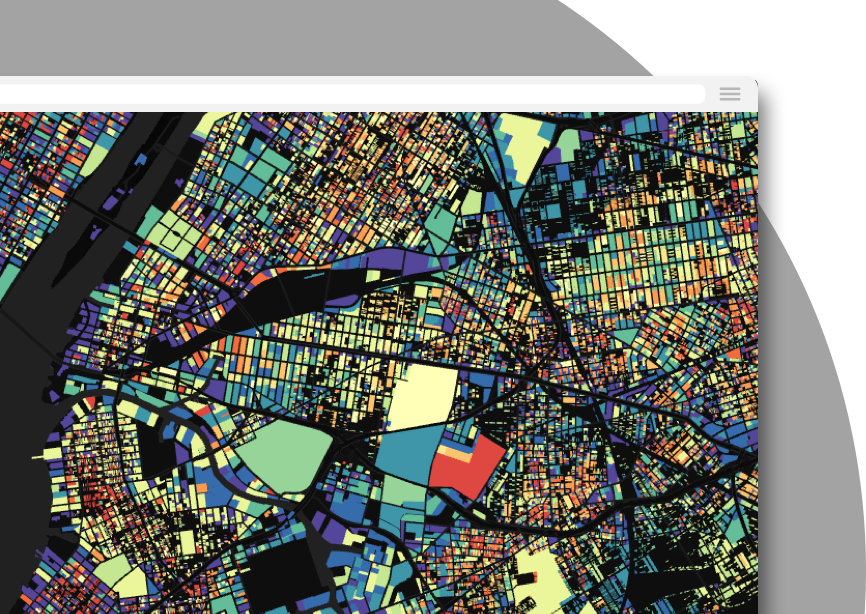

3. Begin locating new Gap stores in proximity to higher-income Kanye following segments

The map above shows the block groups with the highest number of Kanye following households that showed visitation lift after the announcement. Gap can overlay these segments in any DMA when targeting these segments in a site selection strategy.

.png)