Next-Gen Spatial Use Cases for the Utilities Industry

It's a tough time for the Utilities industry both in developed and developing markets. Large players across the sector are concerned about updating their grid infrastructure as well as responding to a rapidly evolving regulatory landscape.

The more innovative companies are also scrambling to see how Artificial Intelligence and IoT can optimize their business models and meet changing customer expectations. IT executives leading this shift across the industry know that Spatial Data Science has a big role to play in driving success.

62% of Utility providers are ramping up their geospatial efforts

According to Gartner 62% of Utilities companies intend on ramping up their investment in geospatial capabilities in the next 3 years which is actually 18% higher than the number of Retailers intent on doing the same.

This doesn't just mean investing in new and innovative software but also finding the next generation of Data Scientists who know how to design models that account for a growing volume of spatial data. However with Data Scientist vacancies up 29% since last year - it can be difficult for more traditional sectors to attract top talent away from tech giants or higher paid roles in Financial Services.

So what business problems can Spatial Data Scientists in the Utilities space expect to face? Which new location-based challenges are cropping up? We spoke to our Customer Success team to see the most common geospatial use cases in the industry:

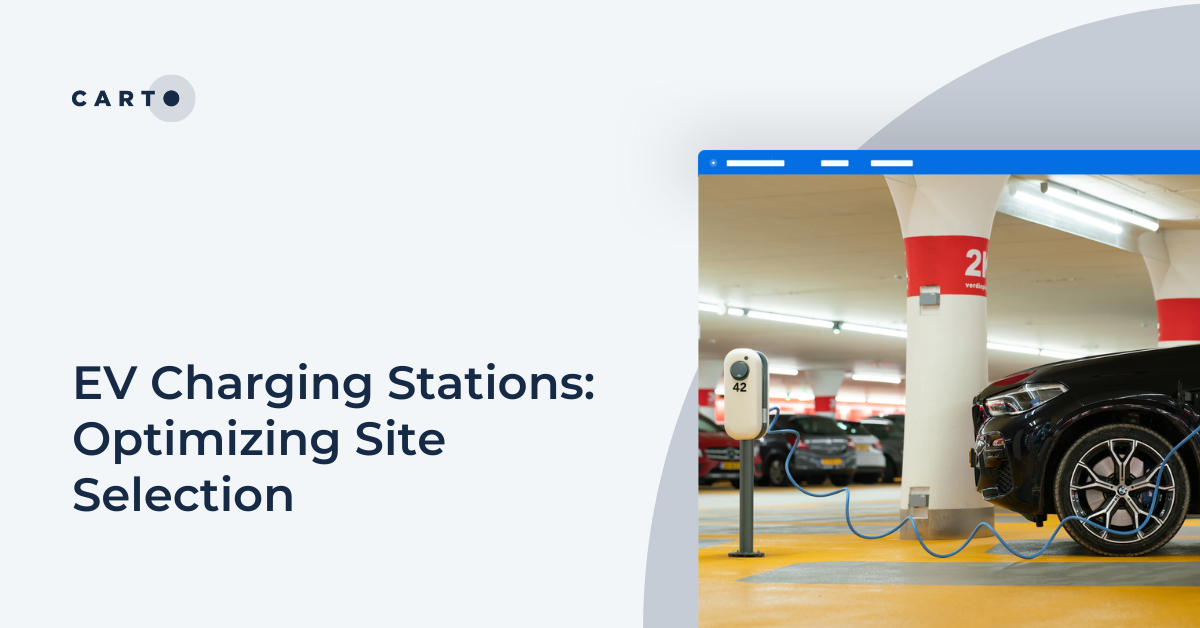

EV Infrastructure Rollout

According to IHS Markit 350 000 new electric vehicles will be sold in the U.S. in 2020 with that number set to rise to 1.1 million in 2025. With the percentage share of vehicles that are electric jumping from 2% to 7% in just 5 years the pressure is on for Utilities providers who need to decide how and where to roll out charging infrastructure. So how can geospatial help?

As mentioned in one of our recent webinars understanding which kind of people are more likely to buy an electric vehicle and where these individuals commute is a critical part of such an analysis. For example research from Reliable Plant shows that 93% of buyers are men and 70% have at least a four-year degree. It also indicates that they are typically environmentally conscious technology driven and frugal travellers.

This means that Data Scientists need to go beyond traditional data sets (such as census data) and use new data streams such as mobile event data. Without this the EV charger to car ratio will be off - as Emu Analytics demonstrated in their report on the UK market. Their spatial analysis showed that with just 1 500 rapid chargers and 3 400 connectors (in May 2018) there was only one rapid charging connection in the UK per 43 cars.

Utilities companies see a big opportunity to generate new revenues from public charging points as well as gaining new business from home charging. Leveraging Location Intelligence will allow them to increase occupancy profitability and therefore customer satisfaction.

{% include icons/icon-bookmark.svg %} Did you miss our Utilities webinar? Check it out!

Solar Potential Analysis

Investing in renewable energy infrastructure is a top priority and ensuring return on investment is critical in order to grow these new business lines in both B2B and B2C.

To give an example from the photovoltaic space as part of the NREL National Renewable Energy Laboratory's energy modelling and forecasting efforts they have developed the below visualization of photovoltaic (solar) supply curves. This analysis of multivariate spatiotemporal data from South Africa allows them to understand the supply and cost of solar energy available nationwide (LCOE = Levelized Cost of Energy).

Equally Solar Potential Analysis can mean something quite different on the B2C side of things - referring to how to convince more consumers to install solar panels in their homes.

Of course location is an extremely relevant factor when it comes to understanding the propensity of a consumer to consider investing in solar panels in their garden or on their roof. Solar is mutually beneficial (in most countries) for both utility providers and consumers - yet the way many Utilities companies market the opportunity often isn't well segmented sending mass audience campaigns to all clients.

However whether or not a client decides to install solar depends on factors such as where they live how environmentally conscious they are how many other people in their neighborhood or social circles have installed solar and of course how much sunlight their rooftop gets. Marketing the transition to solar using more data much of which is spatial allows such campaigns to have a much better return on investment.

Churn Reduction

With annual churn rates at 15% in the domestic utilities industry it's clear that customer expectations are shifting. New competitors with new business models are pushing Utilities marketing and business intelligence teams to reconsider their retention strategies and uncover how location-based data can give them earlier indicators for clients at high-risk of churning.

So how can the location component reduce churn rates? Well many energy firms are now starting to target their online and offline retention campaigns and promotions using more spatial context. By looking at areas where there has already been more churn and which providers those customers have churned to - marketers can send proactive campaigns with special offers or even educate consumers on new products (such as smart meters) which enable them to create "stickiness".

Equally by comparing internal CRM data with >new data streams(e.g. Human Mobility or Real Estate metrics) rather than out-of-date census data analysts in Utilities can get an even better picture of their market share at a more granular level - as well as identifying areas where new properties are being developed and the population is growing making them ripe targets for client acquisition.

{% include icons/icon-bookmark.svg %} Want to learn Endesa's story?? Read it here!

Of course we've seen dozens more Location Intelligence use cases in the Utilities space across our platform - and with the rapid acceleration of renewable technologies and the growth of IoT new applications for geospatial appear on a daily basis. The smartest Utilities providers are treating their data like an asset investing in new data and bulking out their teams to adapt their stack to answer business questions spatially.

Want to know more? Visit our Telco & Utilities homepage.

.png)