Insurance & Reinsurance

Outsmart tomorrow's risks

Reduce complexity and costs, with a streamlined, cloud-native approach for portfolio risk analysis, catastrophe modeling, and fraud detection—all while maintaining flexibility and scalability.

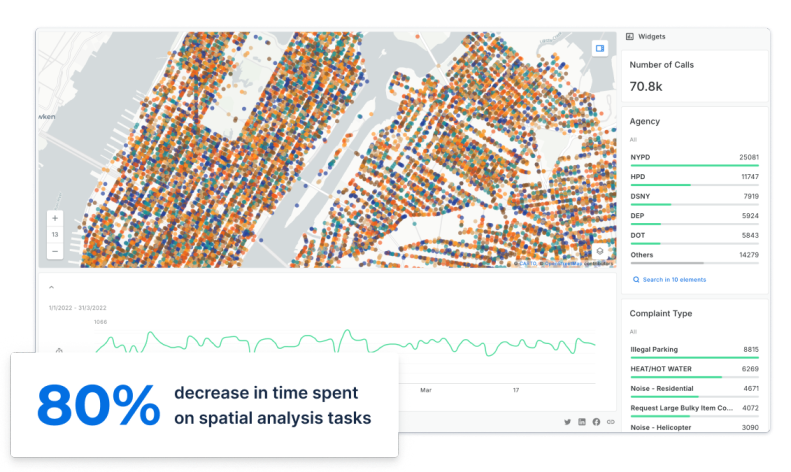

Boost business-analytics collaboration

Analyzing massive data volumes slows down decision-making. Harness cloud-native technology to perform seamless in-depth analysis at scale.

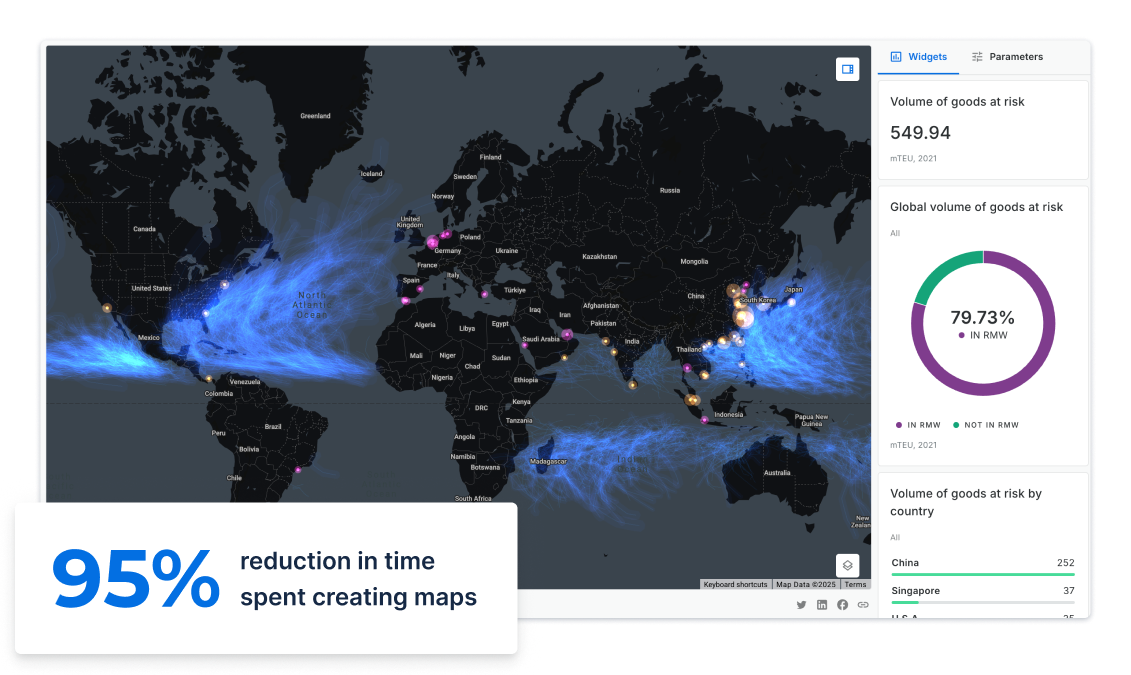

Use real-time insights

Without access to real-time data, organizations struggle to adapt to changing conditions. Stay agile with dynamic dashboards and interactive maps with real-time visibility into your analytics.

Deliver data-driven predictions

Identifying and mitigating risks is impossible without accurate data. Build predictive models to anticipate market changes and adjust pricing strategies effectively.

_logo%201.png)

Get inspired by our customers

Migrating to CARTO’s cloud-native Location Intelligence platform was, without doubt, the right choice for us. The enhanced analytical capabilities of CARTO have opened up our business to new possibilities for more advanced spatial use cases. More than 700 active users of our tools can now work more efficiently to deliver faster and more accurate services themselves.

Webinar

How to Use Spatial Data to Create a Wildfire Risk Index

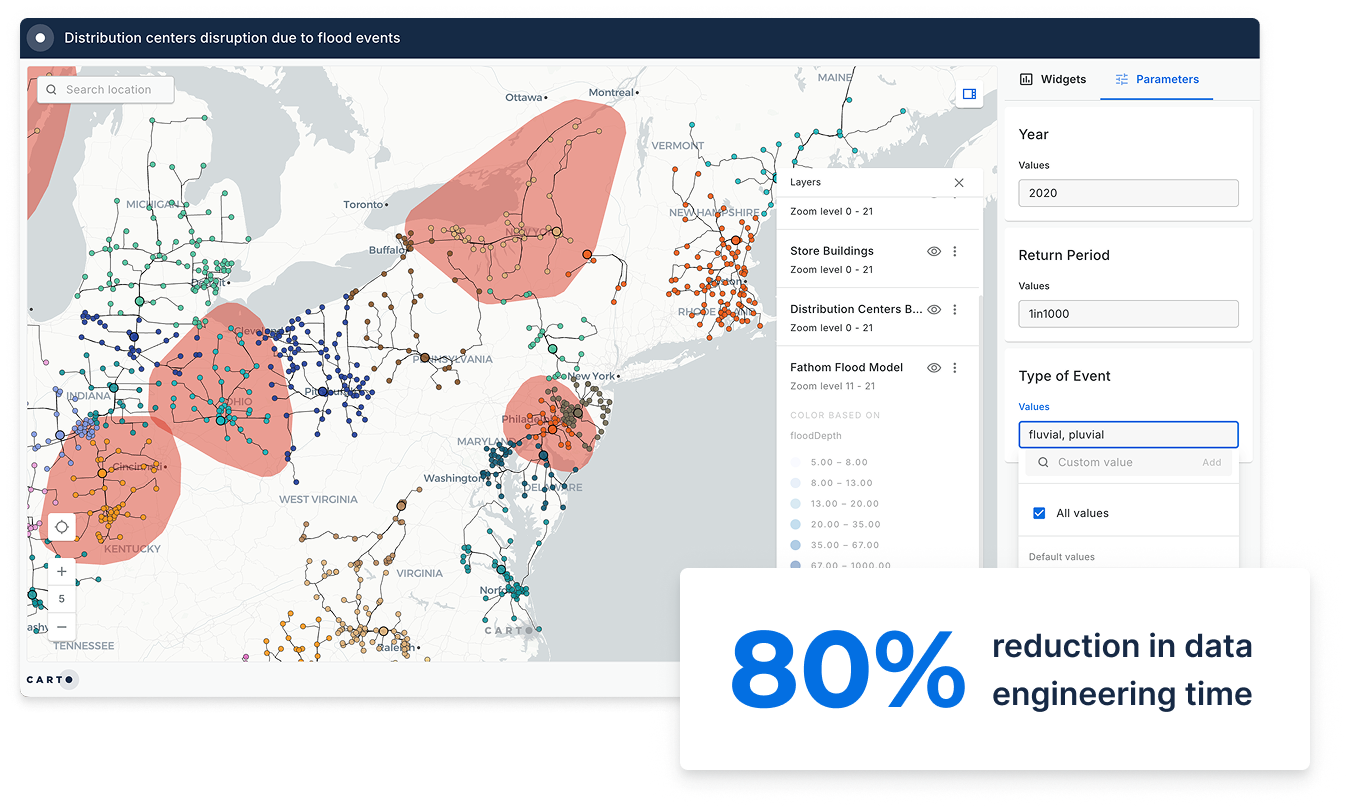

Catastrophe Modeling

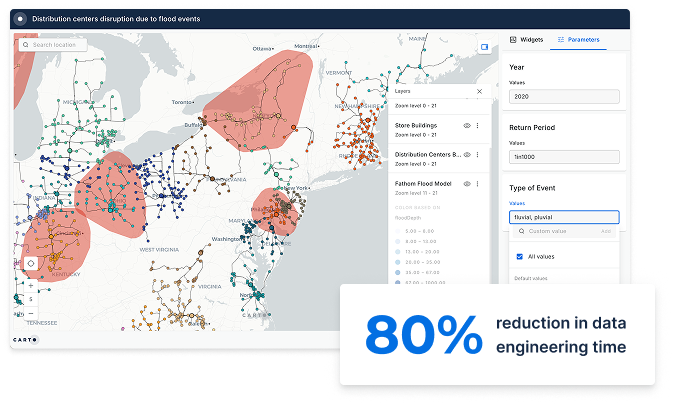

Precision is key when estimating the economic impact of disasters, yet 82% of enterprises cite data quality issues as a key barrier. Harness hyper-local space-time data to accurately predict the impacts of extreme events, enabling informed decisions about insured assets and policy selection.

Exposure Management

Traditional methods for assessing risk exposure can be slow and cumbersome, with 63% of executives saying their analytics capabilities are too siloed to be insight-driven. Gain critical insights through fast and intuitive analyses of large volumes of location data, ensuring a unified perspective on exposure risks across all portfolios.

Risk-based Pricing Model Development

Accurately assessing risk factors can be a complex and time-consuming process, leading to suboptimal pricing strategies. Streamline the evaluation of key risk factors, such as climate events and urban crime rates, using intuitive analytical tools that enhance your pricing accuracy and responsiveness.

Ready to reduce claims costs with spatial analytics?

Related content

TALK TO US

Request a Demo

Schedule a 20 minute meeting with our experts to understand how you can use spatial analysis in your organization.

.jpeg)

.png)

.svg)